In the Media

Repayment Options for Student Loans Explained

October 10, 2018

By WatchBlog

The Department of Education provides billions of dollars in federal student loans for higher education through the Direct Loan program each year. However, as of September 2017, borrowers defaulted on $149 billion worth of federal student loan debt.

Since October 1st is the start of the annual college financial aid application season, we took a look at some options to repay federal student loans if you are going through financial hardship.

Paying based on income

Income-Driven Repayment plans can help if you are facing longer term financial challenges. These plans extend your repayment period beyond the typical 10 years and can lower your monthly payment by setting it as a percentage of your income (with payments potentially as low as $0). If you repay your loans with these plans for 20 or 25 years, you can have your remaining loan balance forgiven. However, you should consider the trade-offs of an Income-Driven Repayment plan because although the monthly payments are more affordable and you may receive loan forgiveness, it can end up costing you more over the long term.

Postponing payments

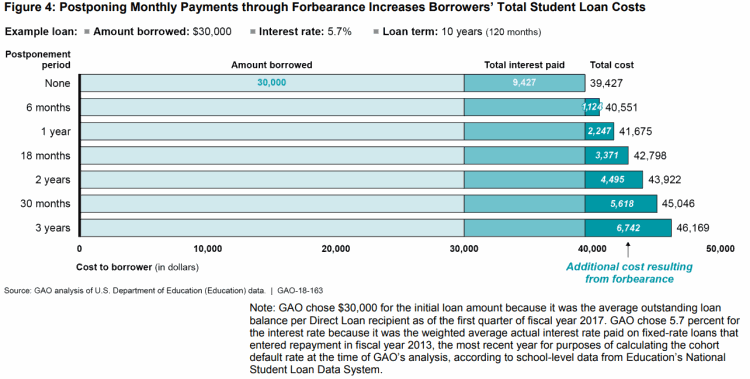

Forbearance is an option if your financial hardship is temporary because it lets you postpone making payments on your federal loans. We found that 68 percent of borrowers who began repaying their loans in 2013 used forbearance in the first 3 years of repayment, and one-fifth had loans in forbearance for 18 months or more.

But forbearance comes at a cost. Interest will accumulate and be added to your loan balance during the forbearance period, resulting in higher monthly payments when the period ends. And we’ve found that this interest can add up.

.png?lang=en-US)

Other path to loan forgiveness

If you are pursuing a career in public service you may also qualify for loan forgiveness. Public Service Loan Forgiveness (PSLF) forgives the remaining balances of borrowers’ federal Direct Loans after they make at least 10 years of qualifying payments while working for a government organization or certain nonprofits—as well as meeting other requirements. Borrowers must also be enrolled in certain repayment plans to qualify, including any of the Income-Driven Repayment plans.

However, as of April 2018, less than 1 percent of borrowers that applied had met the requirements and been granted loan forgiveness. The Department of Education has tried to educate borrowers about PSLF but the large number of denied borrowers suggests that many are still confused about the program requirements. Common reasons borrowers do not qualify are because they have the wrong type of loans (only federal Direct Loans are eligible), they do not work for a qualifying employer, or they are not on a qualifying repayment plan. If you are working towards Public Service Loan Forgiveness, you can check to see if your loans and employment are eligible and track your progress toward loan forgiveness by voluntarily submitting an Employment Certification Form.

We recommended that the Department of Education provide additional information to borrowers to help them determine if they qualify.

Check out our reports to learn more.