Blogs

The Early Bird Still Gets the Worm: Early FAFSA and PPY in Year Two

May 29, 2018

By 67

.png)

Two years ago, the FAFSA application was made available to students on October 1, three months earlier than in previous years. It was also modified to require the use of Prior-Prior Year (PPY) taxes, a change that allowed students to report their family’s taxes from the year before last. In previous years, families had to file their federal income taxes as soon as possible, which was often a challenging and stressful requirement for many students and their parents.

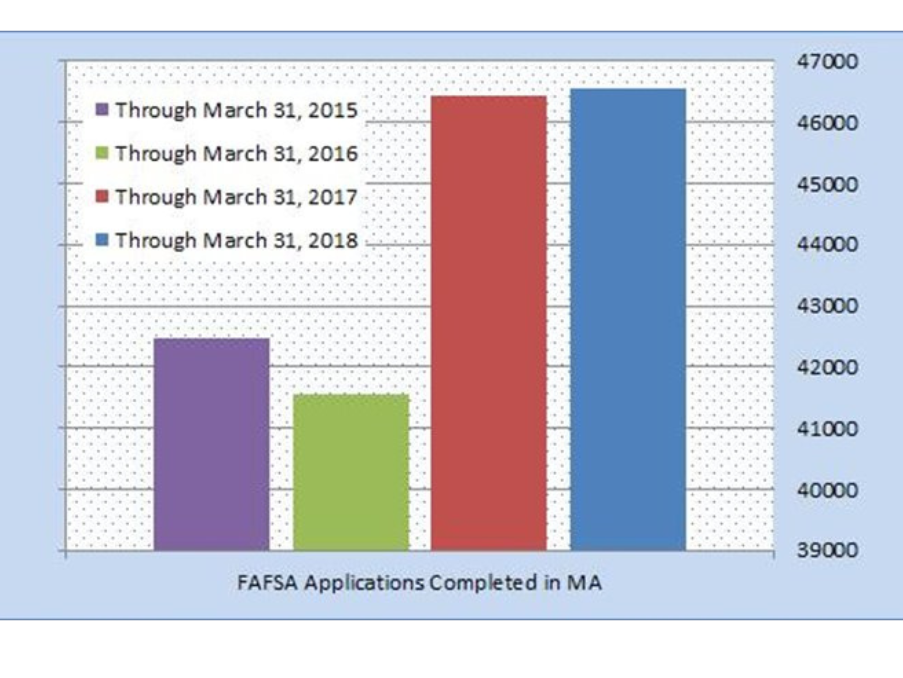

Early results show that for the second consecutive year the rate of FAFSA completion in MA has exceeded the previous year. As of March 31, Massachusetts high school students had completed 46,540 applications, a slight increase from last year’s mark, but a net 12% jump in completion over the past two years*, which is further evidence that these major changes to the financial aid landscape are having a significant impact.

Early FAFSA:

During the 2016-17 school year, uAspire advised 3,555 Massachusetts high school seniors through our high school Afford program, and helped 1,818 students certify their FAFSA, which includes reviewing each Student Aid Report for any oversights on their initial FAFSA submission. This is extremely important because if any errors are not corrected, it could cause a student to not be awarded financial aid. Our advisors also reviewed financial aid award letters with 1,105 students, enhancing their ability to make an informed financial decision when choosing a college. This year, Afford Advisors have certified 1,948 (and counting!) FAFSA submissions, and award letter reviews are on pace to surpass last year’s total.

Our success in adjusting to the earlier timeline provided us with some important lessons. In the first year of Early FAFSA, many of our advisors and school partners worried about how the new deadline would affect students overall application process and wanted to shift our programming to earlier in the school year. This was reflective of an overall atmosphere of uncertainty among all stakeholders in secondary and higher ed, as the new policy unfolded. Key lessons learned over the past two years include:

- Most other deadlines for applications, like the CSS Profile and state financial aid programs, remained unchanged despite the earlier FAFSA deadline.

- The October 1 deadline led students to submit a FAFSA before their college lists were complete. This resulted in more updates to FAFSA as college lists were finalized through the fall and winter.

- While students did tend to receive some financial aid offers earlier than previous years, few students received all their award letters. This resulted in a partial win, since students had more time to review and understand college costs required for a handful of institutions, yet students did not have more time to compare award letters across their school options.

Last year, uAspire began exploring opportunities to amplify our work by connecting with students in their junior year of high school. In our traditional high school advising model, our work has begun in the fall of senior year with a planning session, wherein advisors help students identify a college list with affordable options, followed by FAFSA completion in the winter months. Early FAFSA compressed this timeline and advisors were often forced to spend their initial planning sessions focused on FAFSA completion, before the student had been educated on college financing and student debt, or the importance of identifying a “financial safety school.”

Our internal data analysis reflects this shift. By mid-winter, our number of FAFSAs submitted had increased by nearly 45% over the previous year, and our number of FAFSAs certified increased by over 600%. While it is encouraging that students are submitting their financial aid forms earlier, we want to make sure that this does not come at the expense of identifying affordable options for their FAFSA college list, earlier in the process.

Our hope is that by taking initial steps to identify colleges and prepare for the FAFSA before the start of senior year, students will be in a stronger position to make informed decisions about which schools to include on their college list when they complete their FAFSA. We believe this early work is particularly important for students with special circumstances, such as undocumented students and those in foster care, who may require additional time to collect and submit supplementary documentation, along with their FAFSA application.

Prior-Prior Year (PPY):

While rolled out in conjunction with early FAFSA, PPY also presented its own opportunities, challenges and learnings. Most importantly, we found that utilizing PPY, via the IRS Data Retrieval Tool (DRT), effectively achieved its intended impact of increasing and simplifying FAFSA completion. However, the “verification” process continues to be a giant burden on students and families making the least amount of income, who are often disproportionately affected.

Almost one in two low-income students nationwide are selected for verification; a process that requires families to provide specific documentation on income and demographics. This presents a significant barrier to accessing financial aid, especially when over 90 percent of these audits affect applicants with Expected Family Contributions that would qualify them for a Pell Grant, according to the National College Access Network.

This year, uAspire saw a large surge in verification requests, so our advisors’ focus has been on motivating students to review their Student Aid Reports, even when they do not need to make updates, as a means of early-detection for verification. Our program is also increasing the use of text message reminders for students to be attentive for verification requests. We believe this outreach is critical to ensure that students who complete the FAFSA are able to access financial aid. Because as we have learned, delays in completing verification hampers students’ eligibility for aid awarded on a first-come, first-served basis. Most state financial aid deadlines are several months later, so students who are able to complete the verification process quickly can maintain their eligibility for that aid.

But despite the increase in verifications, we believe that PPY is a big win overall for students and parents. In particular, the ability to use the IRS DRT with PPY significantly reduced the strain that families previously experienced with the compressed timeline to complete their taxes. Students can now access this already verified information with the click of a mouse. By decreasing the complexity and time pressure, students and families can devote more time to making an informed college choice based on accurate tax information.

With any major policy or systems change, there is never a perfect solution. But the best reforms are the ones that can show an immediate positive impact and have the ability to adjust over time, especially when issues arise pertaining to equity and access. The significant increase in FAFSAs completed over the past two years is a strong sign that things are moving in the right direction, but there are still opportunities to make adjustments that will hopefully diminish the number of verification requests, thereby ensuring the promise of these policy changes is realized.

_____

* FAFSA data does not include application completions from high schools with less than five total submissions/completions processed through March 2nd.