News and Updates About Federal Financial Aid & the FAFSA: Students | Practitioners

Tax Forms

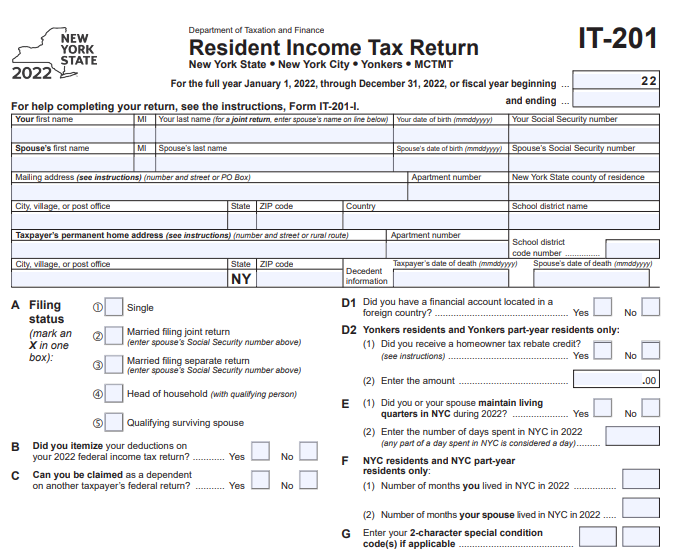

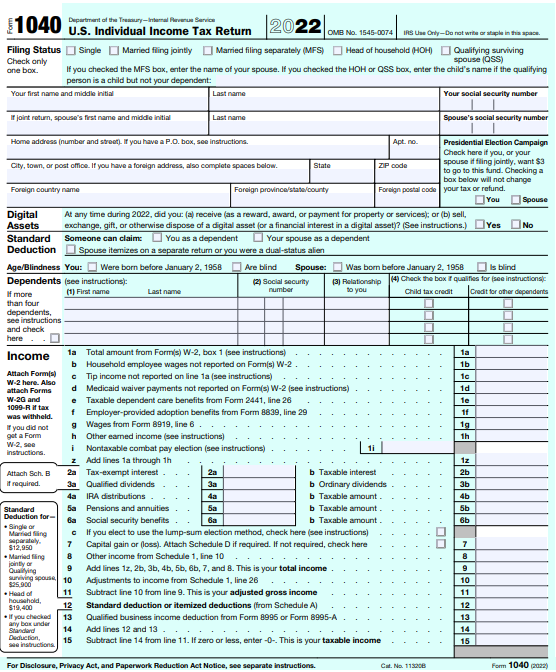

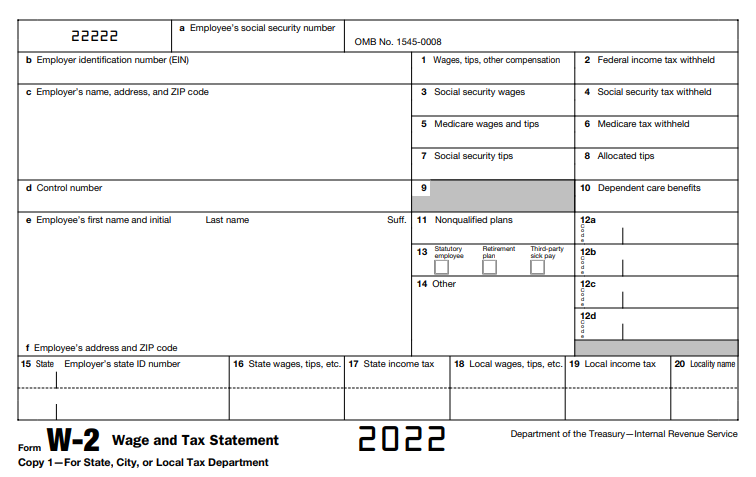

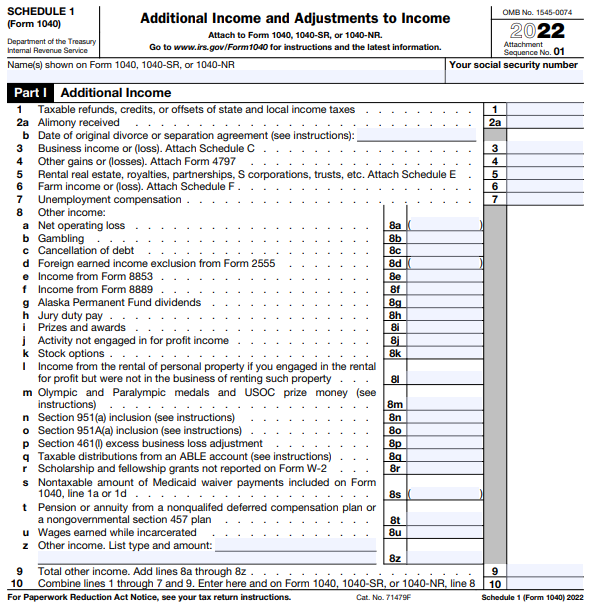

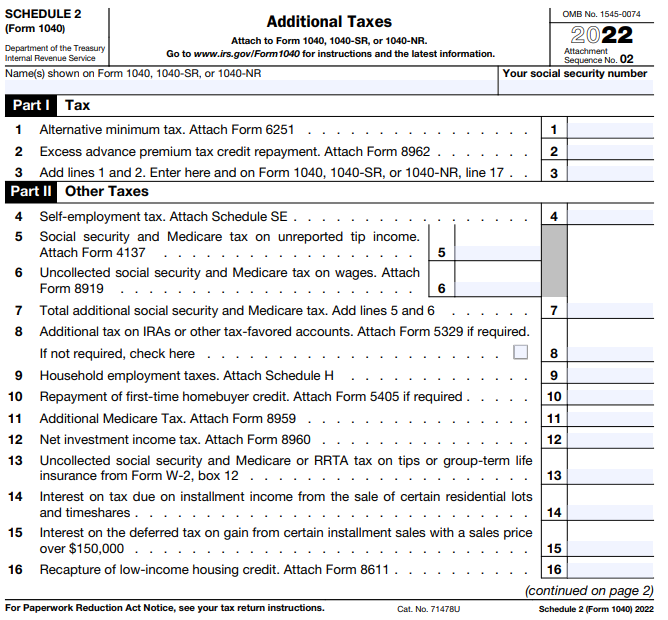

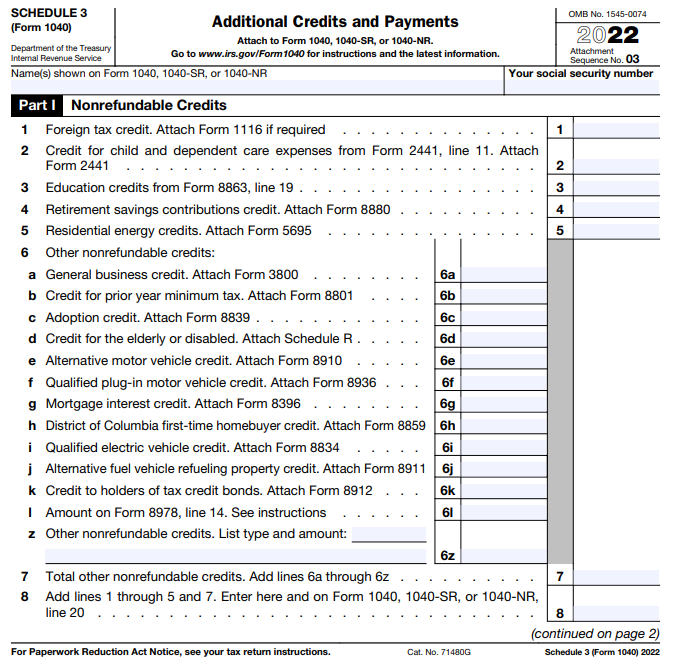

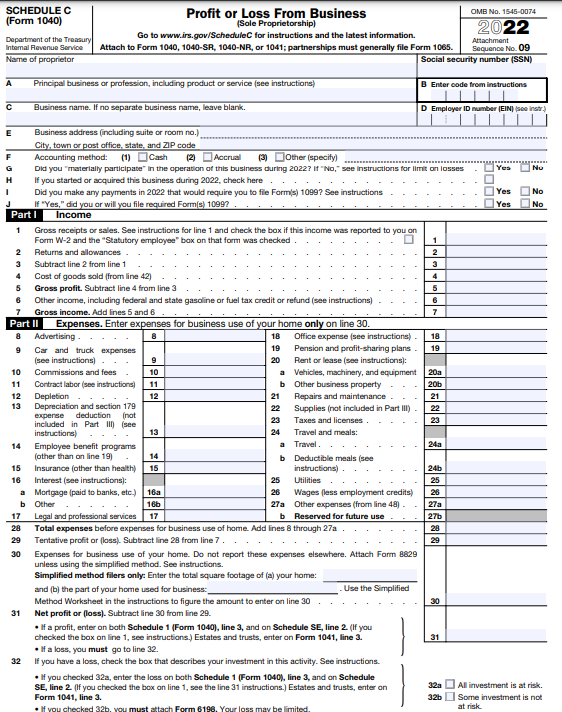

Most tax-filers have a Form 1040 and a W-2. Depending on the types of income and deductions in that tax year, some tax-filers will have a Schedule 1, Schedule 2, Schedule 3, and/or a Schedule C. New York residents need form IT-201 for the TAP application.

You'll find examples of these forms below.

Form 1040

W-2

Schedule 1

Schedule 2

Schedule 3

Schedule C

IT-201

New York residents need form IT-201 for the TAP application.