News and Updates About Federal Financial Aid & the FAFSA: Students | Practitioners

Webinars & Blogs

.png)

uAspire’s 2023–24 Impact Report Is Here!

In the Media

.png)

Key Questions for Financial Aid Offer Review Conversations

Blogs

.png)

Tips for Building Financial Aid Offer Review into the College Timeline

Blogs

.png)

Our Experiences and Challenges with the 25–26 FAFSA

Blogs

FAFSA Follow-up and Accessing FAFSA Data

Blogs

.png)

uAspire Receives $3.4 Million Grant from Crankstart

In the Media

.png)

Selected for Verification? Tips to Help You Complete the Process

Blogs

.png)

Colleges Expand Financial Aid Programs With Prices Near $100,000

Financial Aid Events

For Students

.png)

Simplification for a Better Education

Policy

.png)

Navigating Financial Aid Alone- A low-income first-generation student of color perspective on Univer

Policy

.png)

Chutes and Ladders: Falling Behind and Getting Ahead with the Simplified FAFSA

Blogs

.png)

I Tested the Latest FAFSA. It Works Fine. Don’t Celebrate Yet.

.jpg)

What Practitioners Need to Know about the CSS Profile

Blogs

.jpg)

Best Practices for Supporting Students with Their Scholarship Search

What to Expect When the 25-26 FAFSA Launches

.png)

uAspire Appoints New CFO, Casandra I. Scales

Blogs

.png)

Welcome Fall 2024 Policy Fellows Cohort!

.png)

Incorporating College Affordability into College List Creation Conversations

.jpg)

In first year, tuition-free community college program yields data

In the Media

.jpg)

Pennsylvania launches new free resource to help students, families fill out FAFSA form

In the Media

2025-26 FAFSA: What We've Learned and Our Recommendations

The price of college shouldn’t be a guessing game

Growing Up in Weston, MA - A Middle-Class Student’s Perspective on Legacy Admissions

Blogs

.jpg)

Case Study: uAspire Connects Students to Post-Secondary Success

Guiding Students Through Financial Aid Offers Amid FAFSA Changes

FAFSA ‘train wreck’ rollout makes it harder to get to college. What went wrong?

In the Media

.jpg)

Master Narrative of College Access Belies Reality for Today’s Students

Blogs

College financial aid: How to navigate offers in one of the most challenging seasons yet

In the Media

College Uncovered: Buyer Beware

For Students

OPINION: With financial aid processes more broken than ever, here’s what families can do

For Students

Briefing at Boston State House explores universal FAFSA

The Price Isn't Right: The Case for Financial Aid Offer Transparency

FAFSA delays put pressure on overstretched school counselors in Mass.

In the Media

New York Students, Advocates, and Allies Call for Universal FAFSA Policy

What We’ve Learned Since the FAFSA Launch

-(1).png)

Scholarship Support

Blogs

Briefing: Universal FAFSA Policy to Promote College Access in Massachusetts

College Students' Guide to Renewing the New FAFSA

Universal FAFSA: Expanding Financial Aid Access for New York Students

uAspire can help you with the FAFSA at Capital One Cafes

For Students

.png)

What can I do after high school?

Blogs

5 Tips to Complete the 25-26 FAFSA

Blogs

.png)

10 Things to Know About the New FAFSA

Blogs

How to Support Students Through the New FAFSA Timeline

Blogs

Financial Aid Offer Review

Webinars & Training

Summer Steps for Financial Aid

Webinars & Training

.png)

How to Decipher Your Financial Aid Offers

Blogs

.png)

How to keep your financial aid throughout college

Blogs

.png)

You’re at the Finish Line! Steps to Prepare for Life After College

Blogs

.jpg)

Don't Let Scholarships Negatively Affect Your Financial Aid

Blogs

_resize-tiny.png)

Making a College List? Use These Tools to Factor in Affordability

Blogs

.png)

Your College Decision: How to Find the Right Fit

Blogs

.jpg)

Spring 2025 Policy Fellowship Application

Blogs

-(1).jpg)

Supporting Students Before the FAFSA Opens

Blogs

Mass. should add another high school graduation requirement

In the Media

uAspire Announces New CAO, Valeria Wells

Blogs

uAspire's Student Advisory Board

Blogs

New Federal Regulations Require Clearer Financial Aid Offers and Ban Most Transcript Withholding

Blogs

-(500-x-350-px)-(2).png)

A New Effort to Make College Aid Offers Easy to Understand

In the Media

.png)

uAspire Advisors Welcome Back Students

Blogs

Financially Safer Schools Framework

Blogs

.jpg)

College Tuition Payment Plans Can Stick Students With Exorbitant Fees: Report

In the Media

-(6).png)

FAFSA Is Getting a Makeover, Here's What You Need to Know

In the Media

.png)

Move-In Costs For College Freshmen Have Risen Faster Than Tuition

In the Media

.jpg)

Who pays for food, tech and gas during college? How to set a budget beyond tuition.

In the Media

.png)

COE’s Dr. Terry Vaughan III Appointed to uAspire Board

In the Media

College Access Groups Fear Impact of Outsourcing Guidance

Policy

.png)

Celebrating uAspire's Last Dollar Scholarship Recipients

Blogs

.png)

uAspire Denounces Supreme Court Rejection of Affirmative Action

Blogs

-(5).png)

Education Advocates Call on Legislators to Invest in Higher Education

In the Media

.png)

Ways to Pay for College

Blogs

-(500-x-350-px).png)

What should I do junior year to prepare for college?

Blogs

.jpg)

Advocates Host MA State House Briefing on Public Higher Ed Finance

Blogs

.png)

Summer Steps to Take Before College

Blogs

.png)

How Much Money Should You Borrow for College? Experts Offer Some Hard Truths

In the Media

-(18).jpg)

New Guide, Research Both Explore Universal FAFSA Policies

In the Media

.jpg)

Opportunities & Challenges of Universal FAFSA

Blogs

-(15).jpg)

Requiring seniors to complete the FAFSA

In the Media

-(16).jpg)

Lawmakers want all Mass. students to apply for federal student aid

In the Media

-(14).jpg)

Mass. Board of Higher Ed discusses bill to make federal financial aid submissions mandatory

In the Media

.png)

Yes, Colleges Really Can Cut Your Financial Aid if You Win Other Scholarships

In the Media

.png)

Creating an Equitable Universal FAFSA Policy for New York Students

Blogs

.png)

Supporting Universal FAFSA in Massachusetts

Blogs

-(8).jpg)

Students Deserve Simpler Fin Aid Offers, the Understanding the True Cost of College Act Will Help

In the Media

.png)

As colleges quit US News rankings, how do you pick a school?

In the Media

Higher ed chair backs $335M in new aid investments

In the Media

-(1)-(1).jpg)

Mass Higher Ed Advocates Urge More Investment In Students

In the Media

-(3).jpg)

Event Recap | The Time is Now: Ending the College Affordability Crisis in Massachusetts

In the Media

-(4).jpg)

MA Advocates of Higher Ed Set Goals for Fair Share Revenue

In the Media

.png)

Low-Income Students Can Get More Money to Help Pay for College This Year

In the Media

uAspire’s Guide to Finding and Applying to Scholarships

Blogs

-(small).png)

Five Tips for Completing the CSS Profile

Blogs

GAO Report on Financial Aid Offers Shows Little Has Changed, Progress is Needed

Blogs

Board of Higher Ed to recommend doubling financial aid, updating how colleges retain revenue

In the Media

.png)

Advocates call on Legislators and Healey-Driscoll Administration to act on Board of Higher Education

Blogs

.jpg)

uAspire: Financially Safer Schools

In the Media

.png)

uAspire Advisors Welcome Back Students

Blogs

Making a College List? Use These Tools to Factor in Affordability

Blogs

Financial Aid for All Website Launches

Blogs

.png)

You’re not imagining it, furnishing a dorm room really does cost more this year

In the Media

-(6).png)

WinnCompanies Scholarships Top $575K to Community Residents, Staffers’ Children

In the Media

-(1).jpg)

WinnCompanies Awards Scholarships to 60 Residents of Apartment Communities in 11 States and 10 Child

In the Media

.png)

Celebrating uAspire's Last Dollar Scholarship Recipients

Blogs

uAspire Student Policy Fellows Spotlight

Blogs

uAspire Student Alums Spotlight

Blogs

-(2).jpg)

A Pragmatic Playbook for Impact

In the Media

-(5).png)

League of Women Voters’ Civic Social features Access To Town Meeting Committee progress report

In the Media

First Ones 2022

Blogs

-(4).png)

Transcript: Jonathan Lavine

In the Media

College financial aid troubles follow those who received pandemic unemployment benefits

In the Media

Jobless benefits’ unintended fallout: Reduced college financial aid

In the Media

3 Ways College Financial Aid Letters Can Confuse Families — and What to Do About It

In the Media

.png)

Kids and Money: Where to get free help filing the FAFSA

In the Media

Student Debt Impact

Blogs

First Ones Honorees

Blogs

Colleges Improve Financial Aid Offer Communication to Promote Student Success

Blogs

.png)

Support uAspire this Giving Tuesday

Blogs

.png)

Thank you from our students

Blogs

MassBay and uAspire Partner to Increase FAFSA Completion

Blogs

Bristol Eastern will take part in Connecticut FAFSA challenge

In the Media

Support the Massachusetts Hunger-Free Campus Initiative

Blogs

This Community College Degree Can Earn You $113,000. This Stanford One Just $24,000

In the Media

Lamont: 40 Schools to Participate in FAFSA Challenge

In the Media

Governor Lamont Announces 40 High Schools Selected To Participate in Connecticut FAFSA Challenge

In the Media

Bill Draws Bright Lines on Student Transcript Access

In the Media

Attending College Next Year? It’s Time to File Your FAFSA to Find Out About Financial Assistance

In the Media

Will a new program increase access to college? Framingham and Milford students say it does.

In the Media

Report Examines Lack of Financial Aid Among College Students in Massachusetts

In the Media

Report Examines the Lack of Financial Aid Among College Students in Massachusetts

In the Media

Financial aid packages still burden students with debt, report finds

In the Media

Gloucester woman testifying for hunger-free campus initiative

Policy

SSU student testifying for hunger-free campus initiative

In the Media

.png)

What’s New on the 2022-2023 FAFSA

In the Media

uAspire Spearheads Letter Urging Congress to Allow College Students Access to Food Assistance

Blogs

.png)

uAspire Advisors Welcome Back Students

Blogs

What’s Changing in the New FAFSA and What’s Not

In the Media

Application for the 2022 Student Advocacy Fellowship Opening Soon

Blogs

.png)

How Much College Debt Should Students and Parents Take On? Here’s How to Figure It Out.

In the Media

Financial aid is complicated, the value of simplifying it is easy to understand

In the Media

New CA law encourages students to cash in on free financial aid

In the Media

Celebrating uAspire's Last Dollar Scholarship Recipients

Blogs

Groups Ask ‘U.S. News’ to Exclude SAT and ACT Scores

In the Media

What You Need to Know About Campus Health Insurance

In the Media

.png)

An Open Letter to The Editors of US News and World Report’s Best Colleges Rankings

In the Media

SFUSD College Ambassador Program Paves Students’ Path to College

In the Media

.png)

Partnering for Impact

Blogs

There’s Still Time to Reignite College Aspirations for the Class of 2021

In the Media

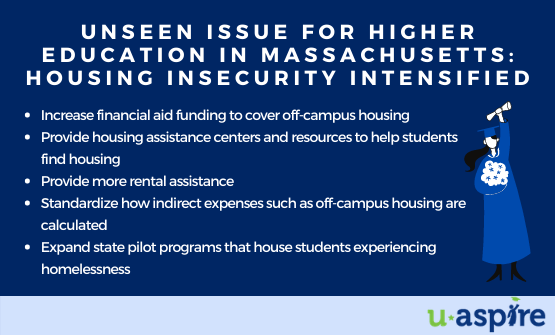

Unseen Issue for Higher Education in Massachusetts: Housing Insecurity Intensified

Blogs

You still have time to ask colleges for more financial aid

In the Media

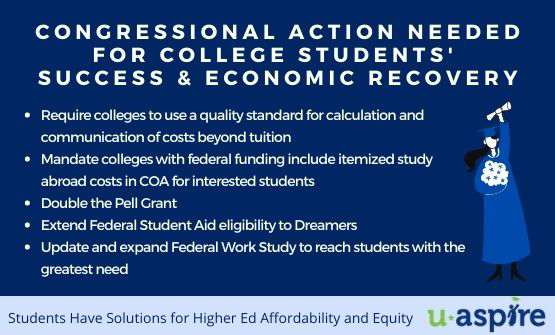

Congressional Action Needed for College Students’ Success & Economic Recovery

Blogs

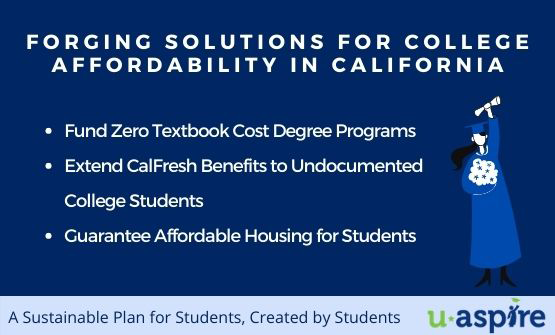

Forging Solutions for College Affordability in California

Blogs

How To Compare Financial Aid Offers In The Age Of Covid-19

In the Media

Your Guide to Decoding Financial Aid Letters and Choosing a College You Can Afford

In the Media

.png)

Redefining Student Support

Blogs

uAspire's College Cost Calculator

Blogs

.png)

A Quick Guide to Financial Aid Award Letters

In the Media

California must go all in for financial aid

In the Media

As admissions season descends, wealthier applicants once again have the advantage

In the Media

.png)

Racial equity at the forefront—inside and outside uAspire

Blogs

California governor proposes dual-admissions pathway for community college students

In the Media

Reform financial aid for students so that housing is not an incredible burden

In the Media

Students Need Pell Grants to Double

In the Media

OPINION: Nothing can replace relationships between students and advisers, but some tools make a big

In the Media

Cost of College Includes Hidden Expenses for Textbooks, Course Materials

In the Media

How Do Student Loans Work? — Interview With Holly Morrow, Sr. VP, Knowledge, uAspire

In the Media

.png)

Solutions Students Need to Cover the Real Cost of College

Blogs

Op-Ed: Students Should Not be Studying on Empty Stomachs

In the Media

Announcing Jaclyn Piñero as new CEO

Blogs

.png)

Where Parents and Students Can Get Help With the Fafsa

In the Media

.png)

A Time of Optimism for College Affordability

Blogs

.png)

uAspire Joins RaiseUp Massachusetts’ Invest in Our Recovery Campaign

Blogs

.png)

Zeroing in on Student Advising, a Foundation Aims to Pave the Path to College

In the Media

Some Colleges Eye New Student Fees to Cover Virus Costs

In the Media

Report: Costs Beyond Tuition Hold Older College Students Back

In the Media

Do Students Need a Bill of Rights?

In the Media

New Fee on Some College Bills: It’s for the Virus

In the Media

NCAN Alumni Spotlight: Elsa Martinez-Pimentel, uAspire Alum

In the Media

.png)

uAspire Last Dollar Scholarship Awarded to Greater Boston Students

Blogs

The ‘Indirect’ Costs at College Can Involve Nasty Surprises

In the Media

State Must Fulfill its Promise to Underserved Students

In the Media

New Effort Aims to Lift City’s Valedictorians

In the Media

uAspire Pandemic Impact Report

Blogs

Report: Students Struggle to Find Accurate Estimates for Non-Tuition Costs

In the Media

Inconsistent Information on Indirect Expenses

In the Media

.jpg)

Indirect Expenses for Students Often Outweigh Tuition, But Are Hard to Identify, Report Finds

In the Media

.jpg)

Students Tackle Costs #BeyondTheCollegeBill During Virtual Advocacy Week

Blogs

Our Work During COVID-19, Part 3

Blogs

.png)

Time for Action

Blogs

Warriors Community Foundation Supports uAspire During NBA Hiatus

Blogs

Our Work During COVID-19, Part 2

Blogs

Student-Centered Solutions Needed During COVID-19

Blogs

Already, universities Are Planning for a Fall Without Students on Campus — Just in Case

In the Media

.png)

uAspire Virtual Town Hall

Blogs

Coronavirus Makes the College Try a Challenge for High School Seniors

In the Media

Our Work During COVID-19, Part 1

Blogs

SAT Tests Canceled. College Tours on Hold. High School Juniors Struggle With Life Ahead

In the Media

Letter Urging Congress to Address Needs of Students During COVID-19 Outbreak

Blogs

Want to Help Schools Closed by COVID-19? Don’t Pitch Them Right Now.

In the Media

.png)

Tips for Decoding College Financial-Aid Offers

In the Media

Spotlight: Betty Francisco, Compass Working Capital

Blogs

Spotlight: Emanuel Cabrera, EY

Blogs

Spotlight: Bob Gianninno, uAspire

Blogs

.png)

Spotlight: Greg Shell, Bain Capital

Blogs

Spotlight: Cynthia Rivera Weissblum, Edwin Gould Foundation

Blogs

How Buying A Mattress Is Like Choosing A College

In the Media

.png)

Spotlight: Simone Hill, Omidyar Network

Blogs

Community Foundation Increases Student Financial Aid Support Through New Partnership

In the Media

A Glimpse Into “Virtual” Advising

In the Media

Paying for College: What Experts Say Parents Should do to Prepare

In the Media

Can ‘Pay for Success’ Boost Post-secondary Outcomes?

In the Media

Flipping the Classroom to Teach Disability Inclusion Practices

In the Media

Taking a Gap Year? Fill Out the Financial-Aid Forms Anyway

In the Media

In Mass., with College Closure Threat Growing, State Seeking New Powers

In the Media

Massachusetts Considers Enhanced Monitoring of Colleges and Universities as Closure Threat Grows

In the Media

.jpg)

College Affordability Advocates: What Comes After the Admissions Cheating Scandal?

In the Media

OPINION: Three Ways to Help More Low-Income Students Get Through College

In the Media

New Bipartisan Bill Aims to Help Students Understand the True Cost of College

Three Questions for Giuseppe Basili

In the Media

.png)

uAspire Students Advocate for Reforms on Capitol Hill

Blogs

Even With ‘Free Tuition,’ Equity Can Be Elusive

In the Media

Legislation Looks Into College Financial Aid Letters

In the Media

Cassidy Announces 166 Higher Education Endorsements of College Transparency Act

In the Media

How To Calculate The Cost Of College: A Guide To Financial Aid Terms

In the Media

Confused By Your College Financial Aid Letter? You're Not Alone

In the Media

City Visions: College Success Without the Scandal

In the Media

Working within the System: A Conversation about Challenges and Opportunities

In the Media

Feds Recommend Colleges Clarify Financial Aid Offers

In the Media

Ed Dept Gives Guidance on Transparent Financial Aid Offers

In the Media

Access Begins with Affordability

In the Media

How Much Is Higher Education Really Going To Cost?

In the Media

Before Deciding on a College, Look Closely at the Financial Aid Letter

In the Media

.png)

Letter To Congress On Financial Aid Offer Letters

In the Media

Redesigning the Financial Aid Offer Letter at the University of Pennsylvania

In the Media

Here's What To Do Before Saying 'Yes' To College Financial Aid (Opinion)

In the Media

The Value Of Financial Literacy And Self-Advocacy

In the Media

Check That Financial Aid Letter Before Making Decision On College

In the Media

How to Decipher Those College Financial Aid Offers

In the Media

Cal State Application Fees Expected To Rise To $70 Per Campus Amid Access Concerns

In the Media

uAspire Hosts Inaugural New York First One Awards Event

Blogs

.png)

uAspire Raises $326,000 To Fund New York City College Affordability Assistance Program

Blogs

uAspire/GBREB Foundation Scholarship Leadership Breakfast Raises Record $572,000

In the Media

uAspire Raises $572K at Annual Leadership Breakfast, a Record

In the Media

Financial Wellness How-Tos: Preparing Families for the Real Cost of College

In the Media

College Admissions Scandal Reveals Vast Inequalities in Higher Education

In the Media

uAspire Last Dollar Scholarships Awarded to 16 Greater Boston Students

Blogs

Some Colleges Target Jargon in the Name of Student Success

In the Media

Financial Aid Offerpalooza

In the Media

Priced Out of a Dream: Staunton Woman Struggles to Find Her Way Back to College

In the Media

.png)

Here’s A No-Brainer: Students Should Know What Their College Costs Will Be

In the Media

Jeannie and Jonathan Lavine Donate $7.5 Million to uAspire and Launch Matching Gift Challenge

Blogs

When It Comes to Borrowing for College, It Pays to Do Homework

In the Media

Why Finding Out How Much a College Costs is Harder Than it Looks

In the Media

Colleges Provide Misleading Information About Their Costs

In the Media

Improvements to FAFSA Eagerly Anticipated

In the Media

Two-Thirds of College Students Take On Debt, but Amount Is Rising More Slowly

In the Media

Lawmakers and uAspire Gather at MA State House to Address College Affordability

Blogs

uAspire’s Top 5 FAFSA Tips for Students

Blogs

uAspire Supports Students and Their Counselors on NY DREAM Act Application

Blogs

.png)

It’s Right There In the Name: The College Affordability Act

In the Media

The Case for Price Transparency

In the Media

.png)

Everything to Know About Saving Money for College, According to Experts

In the Media

.png)

uAspire Launches Student Advocacy Fellowship

Blogs

OPINION: Let’s Make the FAFSA Required for a High-School Diploma

In the Media

FAFSA Advising "IRL": Our Work in Action

Blogs

uAspire Applauds 2019 Congressional Efforts on Financial Aid Offers

Policy

.png)

uAspire Celebrates Passing of FUTURE Act

Blogs

Confusion Still Reigns Over Student Aid. Here’s Why.

In the Media

OPINION: Six Lessons from Louisiana about Helping Students Obtain Federal Aid for College

In the Media

uAspire Testifies Before U.S. Senate Education Committee on College Affordability

Blogs

Why is it So Difficult to Figure Out How Much You’re Going to Pay for College

In the Media

Mass. Students Borrowing More to Attend Public Universities

In the Media

Ep 22: College Affordability with Bob Giannino and Allie Negron of uAspire

In the Media

How to Find a College You’ll Love

In the Media

You Got Into College. Congratulations! Here's the Bill

In the Media

On College Success: A conversation with Bob Giannino, uAspire

In the Media

.png)

The Early Bird Still Gets the Worm: Early FAFSA and PPY in Year Two

Blogs

How Schools and Startups Are Hacking College Affordability

In the Media

Financial Aid Letters Often Hide the Real Cost of College

In the Media

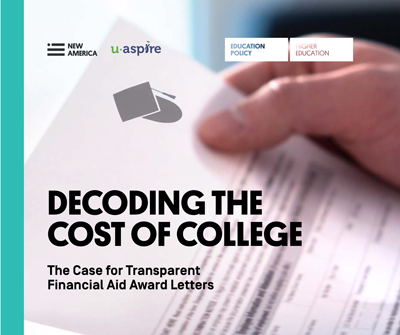

uAspire and New America Release “Decoding the Cost of College”

Blogs

College Financial Aid Woefully Inadequate To Cover Costs Claims New Study

In the Media

Study: College Financial Aid Award Letters Lack Clarity, Transparency

In the Media

.jpg)

The Confusing Information Colleges Provide Students About Financial Aid

In the Media

Financial Aid Letters Are Really, Really Confusing

In the Media

36% of Colleges Are Hiding the Cost to Students

In the Media

Why Are College Costs Less Clear Than Car Prices?

In the Media

.png)

Financial Games Colleges Play

In the Media

.jpg)

A Deep Dive Into New Research on Financial Aid Award Letters

In the Media

.png)

Why Your College Financial Aid Letter May Be Misleading

In the Media

Why 20-Somethings Make Terrific College Counselors for Low-Income Students

In the Media

Ethical College Admissions: Financial Aid Transparency

In the Media

Momentum Grows to Increase Transparency and Consistency of Award Letters—NASFAA Signs On

Blogs

Why So Many Poor Kids Who Get Into College Don’t End Up Enrolling

In the Media

College-Bound? The Fees Could End Up Being a Big Surprise

In the Media

.jpg)

Meet Bay Area Board Member Casey Johnson

Blogs

Tips for How to Pay Back Student Loans

In the Media

Colleges Need to Clarify Just How Much Tuition Really Costs

In the Media

Editorial: Colleges Need to Clarify Real Tuition Costs

In the Media

Editorial: Colleges Should Clarify True Cost of Tuition

In the Media

The Trouble With College Finances

In the Media

.png)

Meet National Board Member Nadine Duplessy Kearns

Blogs

TIAA Unveils the TIAA Difference Maker 100

In the Media

4 Ways Parents (and Their Students) Can Avoid the College Debt Trap

In the Media

.png)

Meet Bay Area Board Member Amit Patel

Blogs

Repayment Options for Student Loans

In the Media

College Possible Receives Inaugural Evergreen National Education Prize

In the Media

TIAA Recognizes uAspire SF Bay Area Advisor for Work Helping Black Students Pay for College

Blogs

New Data Show Some Colleges are Definitively Unaffordable for Many

In the Media

.png)

Early Admission’s Effect on Financial Aid

In the Media

Some Colleges are Totally Unaffordable, and This Tool Proves It

In the Media

Parent’s Guide to the FAFSA and Federal Student Aid

In the Media

136 Names for a Student Loan

In the Media

.png)

uAspire Launches College Affordability Advising in NYC

Blogs

uAspire Announces Partnership with CollegeBound Initiative to Launch College Affordability Advising

In the Media

-(1).png)

Statement of Bob Giannino, uAspire CEO, on the Trump Administration Decision to End DACA Program

Blogs

How Parents Can Help Their Children Avoid Regretting Their College Debt

In the Media

Update on uAspire Partnership with MA Attorney General

Blogs

uAspire Event in San Francisco’s Bayview Helps African American Student’s Prepare for College

Blogs

The Long Story of the Movement Toward College Cost Clarity

In the Media

uAspire Announces Jaclyn Piñero as New Bay Area Executive Director

Blogs

uAspire Hosts 4th Annual College Affordability Lab

Blogs

How Trump’s DACA Decision Affects Colleges and Students

In the Media

.png)

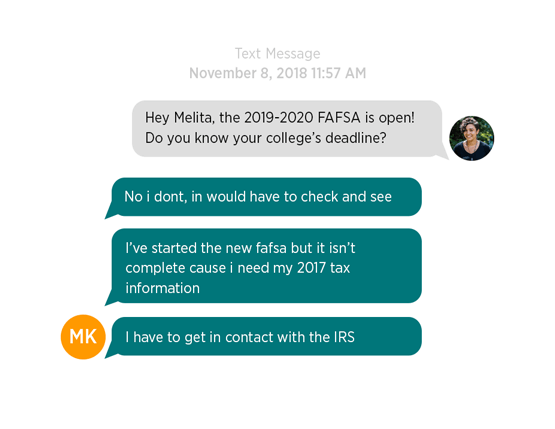

How a Text Message Might Boost College Enrollment

In the Media

uAspire's Exec Director Offers a Quick Lesson on Impact of Higher Ed Costs

In the Media

5 Numbers to Check to Compare Financial Aid Awards

In the Media

.png)

Placement Rates, Other Data Colleges Provide Consumers Are Often Alternative Facts

In the Media

.png)

Student Loan Debt

In the Media

uAspire Partners with MA Attorney General

Blogs

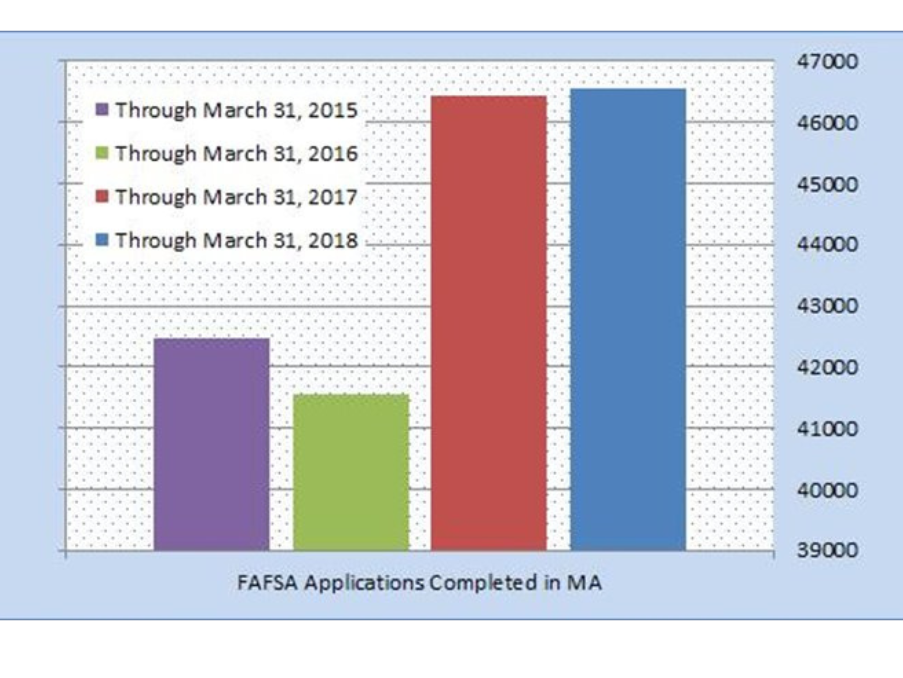

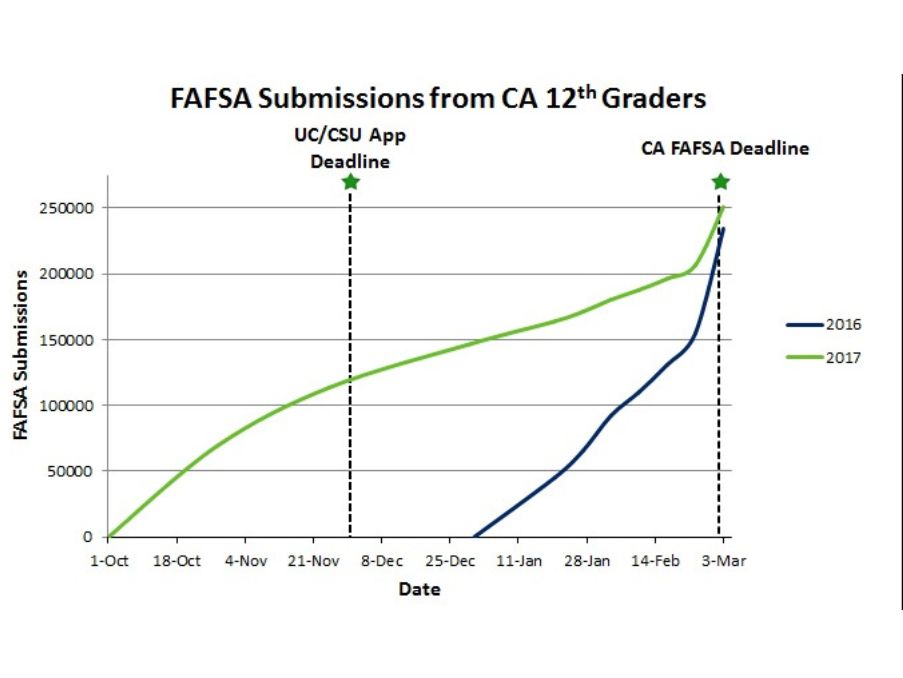

The Results Are In: Assessing the Preliminary Impact of Early FAFSA

Blogs

Can Behavioral Science Help in Flint

In the Media

College Affordability Day 2017

Blogs

uAspire’s MBSK Initiative Hosts Black Family FAFSA Frenzy

Blogs

uAspire: Applying for College Financial Aid

In the Media

The College Debt Crisis is Even Worse Than You Think

In the Media

Why Upperclassmen Lose Financial Aid

In the Media

College Financial Aid Letters Just Got a Little Better (to Read, Anyway)

In the Media

New Twist to Tech Donations: Google Promotes Racial Justice

In the Media

State Street Bank to Create 1,000 Jobs for Inner-city Youth

In the Media

Confusing Financial Aid Letters Leave Students, Parents Adrift

In the Media

Making an Affordable College Choice

In the Media

Make College Costs Manageable for the Entire Family

In the Media

Advisors Work to Freeze 'Summer Melt,' Get Students to College

In the Media

Stopping 'Summer Melt' and Getting More Kids to College This Fall

In the Media

Using Text-Message Reminders to Boost Student Persistence

In the Media

Why Some Students Are No-shows on the First Day of College

In the Media